As devoted dog parents, we all want the best for our furry companions. From premium food to cozy beds, we invest in their well-being. But have you considered pet insurance? In 2025, with advancements in veterinary medicine and rising healthcare costs, understanding insurance for your dog is more crucial than ever. This comprehensive guide will explore the ins and outs of pet insurance for your dog, helping you determine if this type of financial protection is the right choice for your beloved pet and your peace of mind.

Understanding Pet Health Coverage Options

Pet insurance operates similarly to human health insurance. You pay a regular premium, and in return, the insurance company helps cover eligible veterinary expenses. Policies vary significantly in terms of coverage, deductibles, reimbursement percentages, and annual limits. Understanding these components is the first step in evaluating if securing pet insurance for your dog aligns with your needs. You can learn more about different types of pet insurance plans by exploring resources from providers like Example Pet Insurance Company (Outbound Link).

Reasons to Think About Dog Health Insurance in 2025

Several factors make considering pet insurance a prudent decision for your dog in 2025:

- Rising Veterinary Expenses: The cost of veterinary care is steadily increasing due to advancements in diagnostics, treatments, and specialized procedures. Unexpected illnesses or accidents can lead to substantial bills, making dog insurance a valuable consideration.

- Dealing with Unforeseen Accidents and Illnesses: Just like humans, dogs are susceptible to accidents (like ingesting foreign objects) and illnesses (ranging from infections to chronic conditions). Having pet insurance for your dog can provide a financial safety net during these stressful times.

- Accessing Advanced Medical Care: Access to advanced treatments like MRI scans, chemotherapy, and complex surgeries is becoming more common in veterinary medicine. While these can significantly improve a dog’s quality of life, they often come with a hefty price tag. Opting for pet insurance for your dog can make these options more accessible.

- Achieving Peace of Mind with Pet Coverage: Knowing you have financial support for unexpected veterinary expenses can alleviate stress and allow you to focus on your dog’s recovery rather than solely on the cost of treatment. For more on managing pet health costs, see our article on [Link to a hypothetical internal blog post about budgeting for pet care].

Key Factors When Selecting Pet Insurance for Your Dog

When exploring pet insurance options for your dog, pay close attention to these key aspects:

- Understanding What Your Pet Insurance Covers: Know the specifics of your policy. Most plans include accidents and illnesses, but some may offer additional coverage for wellness care (routine check-ups, vaccinations), behavioral therapies, or alternative treatments.

- How Deductibles Work with Dog Insurance: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Deductibles can be annual or per incident.

- Understanding Reimbursement Levels for Your Pet’s Care: This is the percentage of eligible costs the insurance company will reimburse you after you’ve met your deductible (e.g., 70%, 80%, or 90%).

- Considering Annual Limits in Your Dog Insurance Plan: This is the maximum amount the insurance company will pay out in a policy year.

- Being Aware of Policy Exclusions in Pet Insurance: Be aware of any exclusions in the policy, such as pre-existing conditions, breed-specific issues, or certain elective procedures.

- The Importance of Waiting Periods in Pet Policies: Most policies have a waiting period before coverage for illnesses and accidents becomes effective.

- Factors Influencing Monthly Premiums for Dog Insurance: These are the regular payments you make to maintain your pet insurance coverage. Premiums vary based on your dog’s breed, age, location, and the level of coverage you choose. You might find our guide on [Link to a hypothetical internal blog post comparing pet insurance providers] helpful.

Real-Life Scenarios Where Pet Insurance Helps Dog Owners

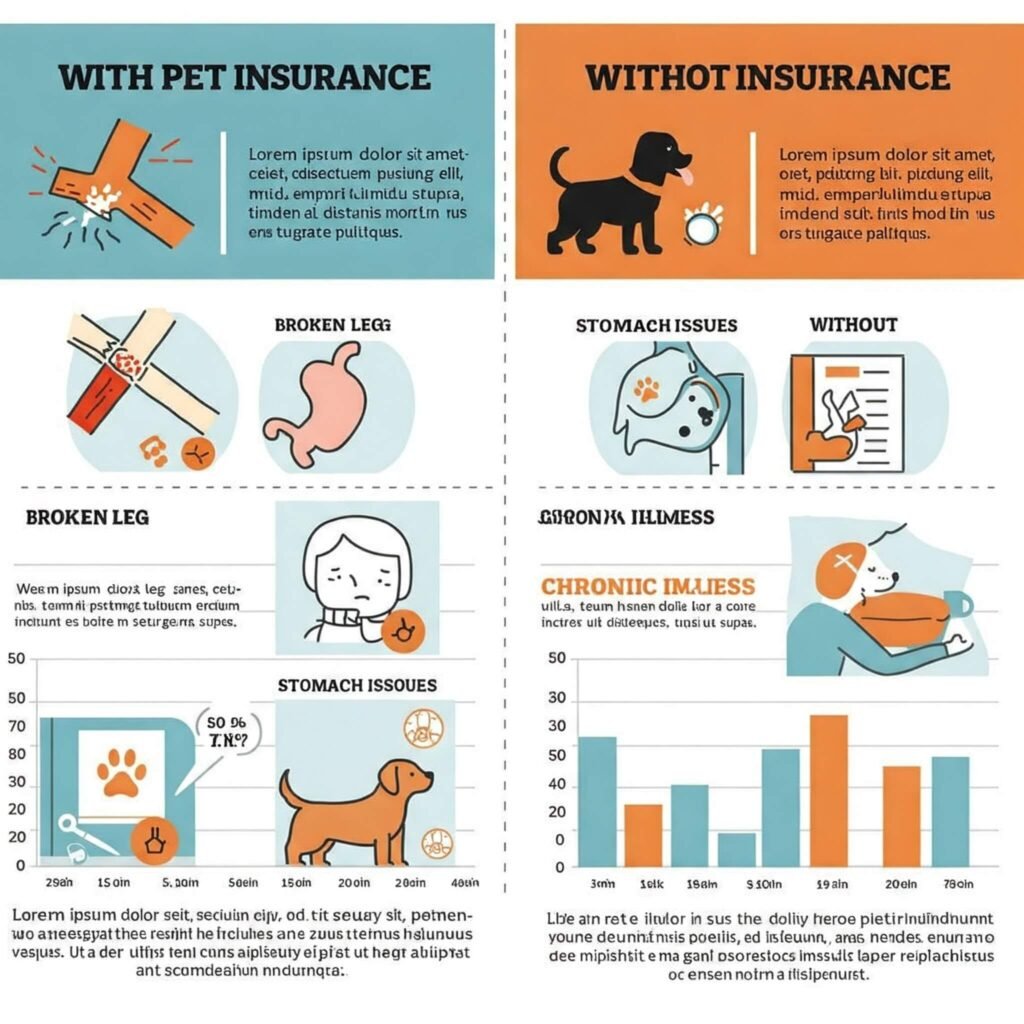

Imagine your playful Labrador Retriever suddenly limps and a vet diagnosis reveals a torn cruciate ligament requiring expensive surgery. Without pet insurance, you might face a bill of several thousand dollars. With a good pet insurance policy, you would likely pay your deductible and a percentage of the remaining cost, significantly reducing your financial burden.

Or consider an older dog diagnosed with a chronic condition like diabetes requiring ongoing medication and regular vet visits. Having pet insurance for your dog can help manage these recurring expenses, making long-term care more affordable. Learn about managing chronic conditions in pets on [Link to a hypothetical internal blog post about senior dog care].

Making the Right Choice About Pet Insurance for Your Dog in 2025

The decision of whether pet insurance for your dog is worth it in 2025 ultimately depends on your individual circumstances, including:

- Your Financial Planning: Can you comfortably afford the monthly premiums associated with insurance for your dog?

- Your Comfort with Financial Risk: Are you comfortable absorbing potentially large, unexpected veterinary bills, or would the security of pet insurance be preferable?

- Considering Your Dog’s Specific Needs: Some breeds are predisposed to certain health issues, and pre-existing conditions are generally not covered by pet insurance.

- Evaluating Your Existing Savings: Do you have a dedicated emergency fund for pet care, or would pet insurance provide a more reliable safety net?

Actionable Takeaway: Research different pet insurance providers, compare their plans and quotes, and carefully consider your financial situation and your dog’s needs. Websites like NAPHIA (North American Pet Health Insurance Association) and Pet Insurance Review offer valuable resources and comparisons to help you find the best pet insurance for your dog.